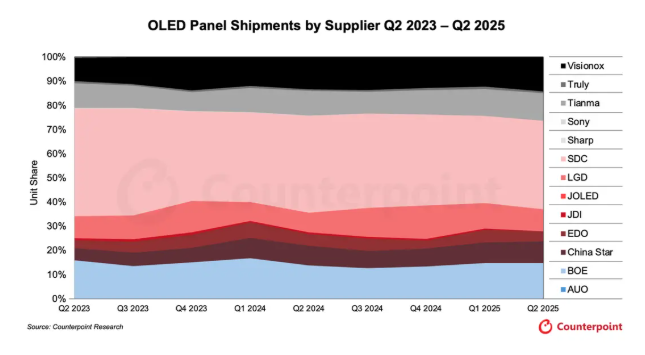

According to recent data released by market research firm Counterpoint Research, in the second quarter of 2025, Chinese display panel manufacturers accounted for nearly 50% of the global OLED market in terms of shipment volume.

Statistics show that in Q2 2025, BOE, Visionox, and CSOT (China Star Optoelectronics Technology) collectively held a 38% share of the global OLED market, an increase of approximately 3 percentage points compared to the previous quarter. BOE ranked second globally with a 15% market share, followed by Visionox in third place with 14%, and CSOT in fifth place with 9%. Samsung Display remained the global leader with a 37% market share, while LG Display also held a 9% share, on par with CSOT. When including the OLED market shares of other Chinese enterprises such as EverDisplay Optronics and Tianma Microelectronics, the overall market share of Chinese companies has approached 50%.

Counterpoint Research pointed out that as the display industry supply chain matures and cost advantages strengthen, OLED panels made in China are rapidly capturing the global market. The latest report predicts that by 2028, the global production capacity share of Chinese display panels will rise from 68% in 2023 to 75%.

To seize the fast-growing OLED market for IT devices such as tablets, laptops, and gaming monitors, Chinese panel manufacturers including BOE, Visionox, and CSOT are accelerating investments in 8.6th-generation OLED panel production lines—essential for next-generation IT devices—and quickly expanding their presence in the growing IT-oriented OLED market. BOE plans to invest 63 billion yuan by 2026 in the construction of 8.6th-generation IT OLED panel production lines. Visionox intends to complete an investment of a similar scale by 2027. CSOT is also expected to officially announce its investment plan for 8th-generation printed OLED panels in the second half of the year.

Counterpoint Research indicated that global OLED panel shipments in Q2 2025 increased by 5% quarter-on-quarter but decreased slightly by 2% year-on-year. In segmented markets, shipments of OLED panels for monitors and laptops both achieved double-digit growth, which further confirms that IT-focused OLEDs are becoming a new driver of growth in the display industry.

In contrast to the rapid advancement of Chinese enterprises, South Korea’s major panel manufacturer LGD (LG Display) has not yet announced its investment plan for 8.6th-generation OLED panels.

Post time: Sep-13-2025