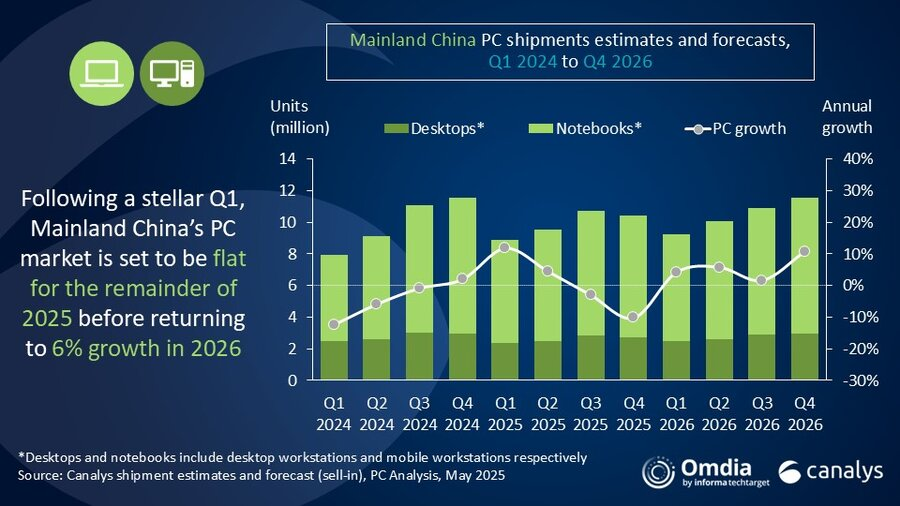

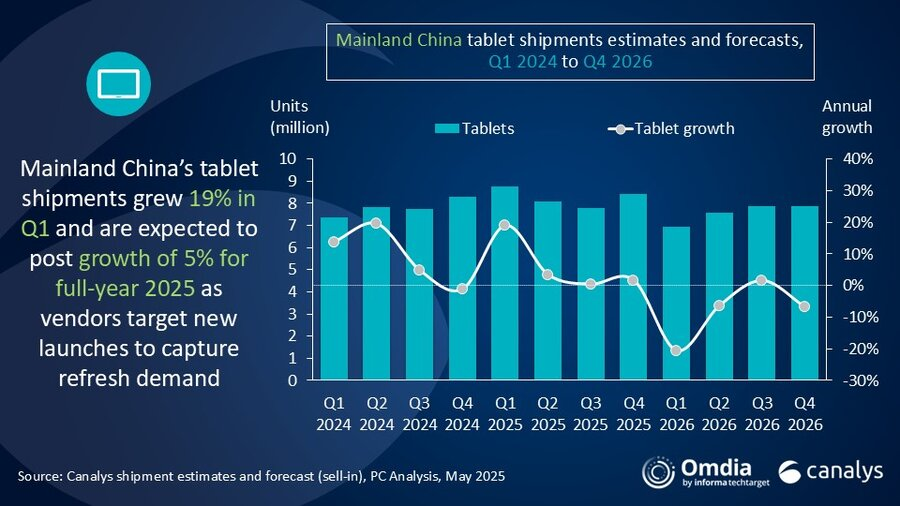

MThe latest data from Canalys (now part of Omdia) shows that the Mainland China PC market (excluding tablets) grew by 12% in Q1 2025, to 8.9 million units shipped. Tablets recorded even higher growth with shipments increasing 19% year-on-year growth, totaling 8.7 million units. Consumer demand for devices was buoyed by government subsidies, driving strong device upgrade activity. Looking ahead, the Mainland China PC market is expected to remain flat in 2025 returning to growth of 6% in 2026. Meanwhile, the tablet market is forecast to grow 5% this year before contracting 8% in 2026.

https://www.perfectdisplay.com/27-inch-dual-mode-display-4k-240hz-fhd-480hz-product/

https://www.perfectdisplay.com/49-va-curved-1500r-165hz-gaming-monitor-product/

https://www.perfectdisplay.com/24-va-fhd-frameless-business-monitor-with-pd-15w-usb-c-product/

https://www.perfectdisplay.com/model-pw27dui-60hz-product/

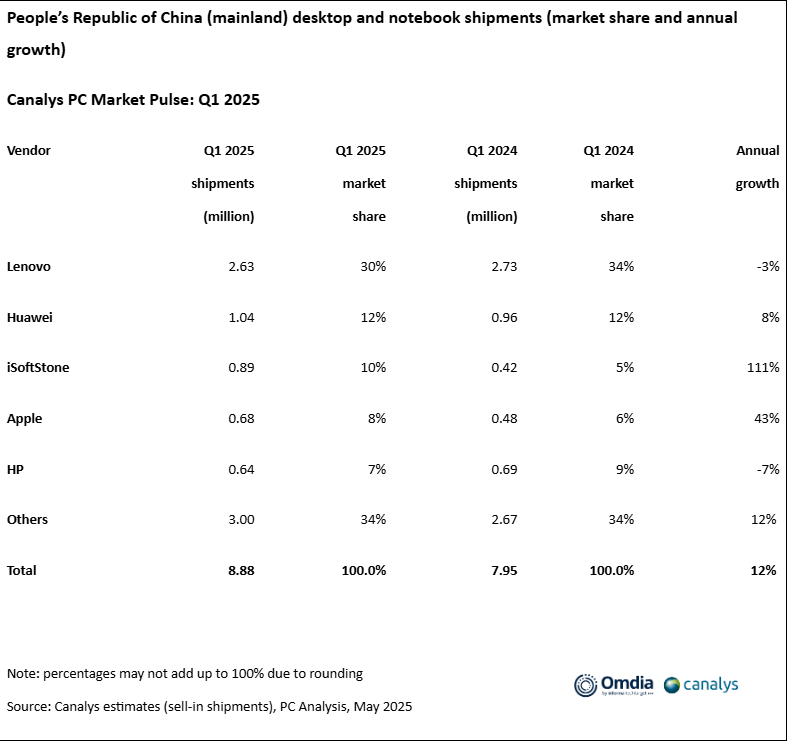

PCPC customer segments in Mainland China faced differing fortunes in Q1 2025. The consumer PC market maintained strong momentum, driven largely by government subsidies. As a result, notebook shipments recorded stellar annual growth of 20%. On the commercial front, success was more muted. PC procurement by large enterprises remained flat, while the SMB segment finally showed signs of a modest recovery, posting a 2% increase following 11 consecutive quarters of decline.

“Mainland China’s PC landscape has evolved significantly over the past two years, shaped by a more competitive landscape for domestic brands,” said Emma Xu, Senior Analyst at Canalys (now part of Omdia). “Consumer-focused Chinese vendors such as iSoftStone, Huawei, HONOR and Xiaomi all reported growth in Q1 2025, gaining share at the expense of traditional commercial heavyweights like Lenovo, HP, and Dell. The recent announcement of Huawei’s HarmonyOS PCs in May could mark another potential inflection point. While it faces an uphill battle to drive consumer and developer adoption, Huawei’s long-standing strength in mobile devices and emerging AI differentiation could see HarmonyOS redefine the competitive landscape for PCs in the mid to long term.”

sThe overall PC market in Mainland China is forecast to remain flat in 2025, as the impact of consumer subsidies diminishes. The SMB and public sectors are expected to grow by 4% and 1%, respectively, this year, as IT investment improves, and the government progresses along its PC refresh plans.

“Mainland China’s tablet market delivered robust performance in Q1 2025, supported by sustained government subsidies,” added Xu. “Domestic smartphone vendors captured an outsized share of this growth, putting pressure on international players. In response, vendors are aggressively expanding their tablet lineups, targeting use-cases like gaming and productivity, and including high-end models with OLED displays. While this trend is set to enhance tablet functionality, success will depend on vendors’ ability to leverage technological advancements to deliver meaningful user experience improvements.” Canalys (now part of Omdia) projects the tablet market to grow 5% year on year in 2025, driven by product innovation at competitive pricing.

Post time: Jun-19-2025