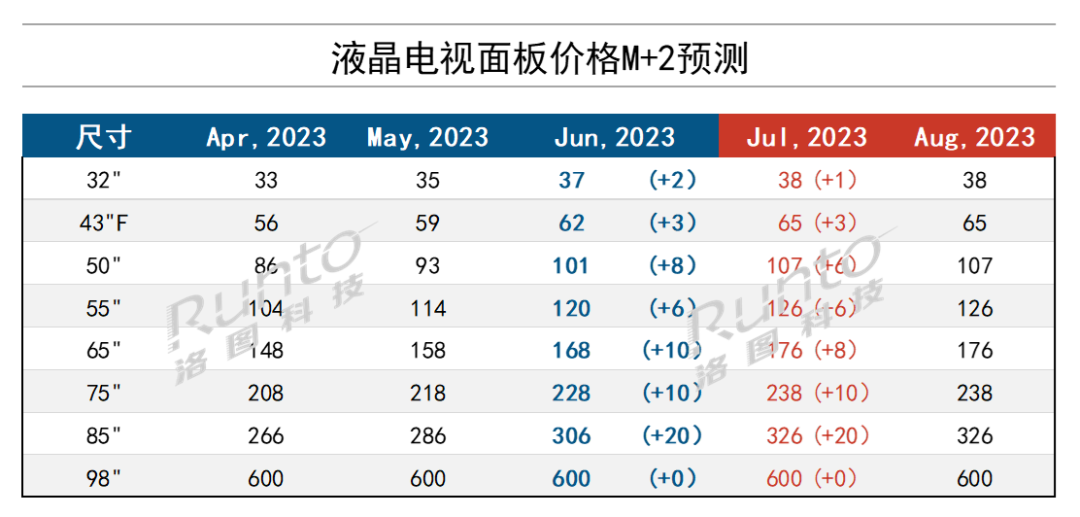

In June, global LCD TV panel prices continued to significantly rise. The average price of 85-inch panels increased by $20, while 65-inch and 75-inch panels increased by $10. The prices of 50-inch and 55-inch panels rose by $8 and $6 respectively, and 32-inch and 43-inch panels increased by $2 and $3 respectively.

The data is from Runto Technology, unit USD

Key points: Currently, it is a clear seller's market. The high price hikes in the panel market since February of this year do not necessarily indicate strong demand. In the game of core industrial products, buyers are at a disadvantage due to supply and bullish market sentiments. From the perspective of sellers, "I am just carefully calculating my profits."

Forecast: Based on the business plans and controlling logic of panel manufacturers, panel prices are expected to continue to rise in July, and all sizes have already reached the breakeven point. The market outlook for August is difficult to predict, so let's stay put for now. However, it is highly probable that prices will continue to rise. Major panel manufacturers are expected to incur a loss of approximately 2.8 billion RMB in the TV panel business in the first half of the year. According to the "calculated profit" scenario, they will maintain this situation until the end of the year, achieving a breakeven. However, whether this script will continue after August remains to be seen, as market sentiments are brewing.

China 618: During the period from May 31st to June 18th, the total retail sales in China's online TV channels increased by about 5% year-on-year, while the total retail volume decreased by about 10%. The average price increased by over 10%. Hisense and TCL performed strongly.

Production capacity: In June, the G10.5 production line of major manufacturers had an operating rate of approximately 90%, while the G8.5/8.6 production line had an operating rate between 80% and 85%. CHOT and AU Optronics were running at full capacity. It is expected that in Q4, the operating rate will be strictly controlled.

32-inch/43-inch: In June, prices increased by $2 and $3 respectively, reaching $37 and $62 for the 32-inch and 43-inch panels. The price for the 43-inch panel reached $64 for small customers. It is expected that there will be an increase of $1 and $3 in July. The future target price for the 32-inch panel is $40.

50-inch/55-inch: In June, the average prices increased by $8 and $6 respectively, reaching $101 and $120. The price of the 50-inch panel varied, ranging from $108 to over $90. Due to LG Display reducing production and internal demand for TV panels from the IT sector, the supply of 55-inch panels was relatively tight, and some small customers settled at $126. It is expected that these two sizes will maintain a $6 price increase in July. The future target price for the 55-inch panel is $138.

65-inch/75-inch: In June, both sizes increased by $10, reaching $168 and $228 respectively. Manufacturers are expected to quote $178 and $238 in July, with the final price increase likely converging.

85-inch: The average price in June increased by $20 to $306, and it is expected to rise by an additional $15-20 in July. The target price for panel manufacturers is $360.

98-inch: The price remained unchanged from May to June, staying at $600.

Post time: Jun-30-2023