As of the evening of October 30, the Q3 2025 earnings reports of listed panel makers have all been released. Overall, results were mixed, with full-year performance under pressure. Panel prices rebounded slightly in 2025, but downstream demand has not yet fully recovered. However, after the downturn in 2024, the global display panel industry has shown a structural recovery in 2025, with leading enterprises seeing significant improvements in profitability.

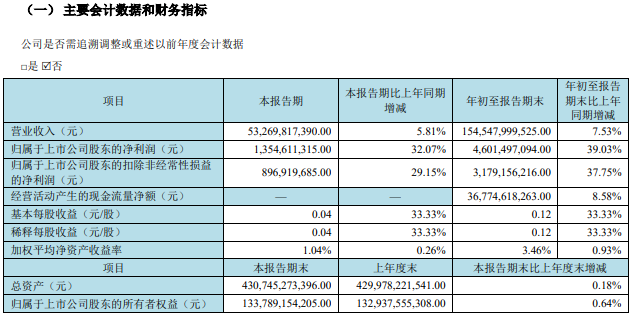

BOE: Net Profit Attributable to Shareholders Rises 39% in Jan-Sep 2025

On October 30, BOE Technology Group Co., Ltd. (BOE A: 000725; BOE B: 200725) released its Q3 2025 report. In the first three quarters, the company achieved operating revenue of 154.548 billion yuan, a YoY increase of 7.53%; net profit attributable to shareholders of listed companies reached 4.601 billion yuan, a substantial YoY growth of 39.03%. Among them, Q3 operating revenue was 53.270 billion yuan, a YoY increase of 5.81%; net profit attributable to shareholders was 1.355 billion yuan, a YoY increase of 32.07%. Guided by the "Nth Curve" theory, BOE has continued to deepen its "Internet of Displays" development strategy, promoting resonance between traditional businesses and innovative ecosystems, and achieving a leapfrog upgrade from technological leadership to sustainable leadership.

As a global display leader, BOE has maintained its leading role in the display field. As of Q3 2025, BOE has retained its global No.1 shipment volume in mainstream application areas including mobile phones, tablets, laptops, monitors, and TVs (Omdia data). Adhering to respect for technology and commitment to innovation, BOE achieved dual breakthroughs in technological innovation and standard leadership in Q3 2025: UB Cell 4.0, a new generation of high-end LCD display technology solutions independently developed based on BOE's industry-leading ADS Pro technology, won the "IFA 2025 Global Product Technology Innovation Award - Gold Award for UB Intelligent Eye Protection Technology"; addressing the gap in image quality grading and evaluation of display products under real ambient light, BOE, together with the China Electronic Video Industry Association and core industrial chain enterprises, released the Group Standard for Image Quality Grading of Flat-Panel TVs Under Ambient Light, providing clear and unified performance evaluation criteria for image quality grading. In terms of technological empowerment, relying on Oxide technology and LTPO technology, BOE has achieved key breakthroughs in IT and small-size display fields, with relevant technological achievements successfully applied to flagship new products of partners such as Lenovo, OPPO, and vivo.

In addition, at the third anniversary celebration of the "Dual-Jing Empowerment Plan" in August, BOE and JD.com announced the further deepening of cooperation. Centering on the core of "resonance between the technology supply side and the consumer demand side", the two parties reshaped the industrial value chain through three achievements: closed-loop technology transformation, brand awareness building, and ecological collaboration upgrading. They also jointly released the "Three Truths Commitment" for 100-inch large screens—"Genuine Quality, Genuine Experience, Genuine Service"—and joined hands with leading industry enterprises to establish the "High-Value Ecological Industry Alliance", promoting the display industry to shift from low-price competition to value co-integration and creating a new engine for sustainable growth in the global display industry.

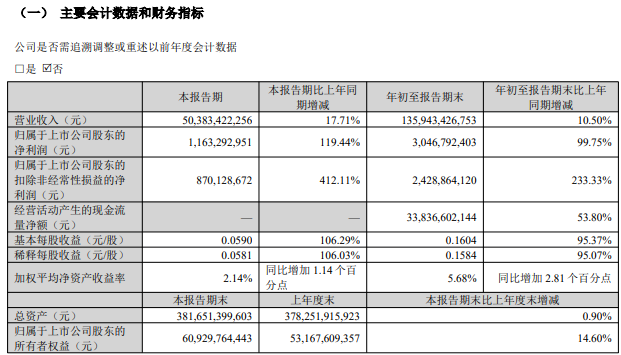

TCL Huaxing: Net Profit Reaches 6.1 Billion Yuan in Jan-Sep, YoY Growth of 53.5%

On October 30, TCL Technology (000100.SZ) disclosed its Q3 2025 report. In the first three quarters, the company achieved operating revenue of 135.9 billion yuan, a YoY increase of 10.5%; net profit attributable to shareholders was 3.05 billion yuan, a YoY increase of 99.8%; operating cash flow was 33.84 billion yuan, a YoY increase of 53.8%. Among them, Q3 net profit attributable to shareholders was 1.16 billion yuan, a quarter-on-quarter (QoQ) increase of 33.6%, with profitability continuing to recover and financial performance improving significantly.

https://www.perfectdisplay.com/model-pg27dui-144hz-product/

https://www.perfectdisplay.com/model-jm32dqi-165hz-product/

The strong growth of the panel business is the main driver of TCL Technology's strong performance growth. In the first three quarters, TCL Huaxing accumulated operating revenue of 78.01 billion yuan, a YoY increase of 17.5%; net profit of 6.1 billion yuan, a YoY increase of 53.5%; net profit attributable to TCL Technology shareholders of 3.9 billion yuan, a YoY increase of 41.9%.

The announcement pointed out that the company's panel business has shown a good trend of "steady progress in large-size panels, rapid growth in small and medium-size panels, and full bloom in emerging fields". Specifically, in the large-size field, the company's market share in TV and commercial display has increased to 25%, maintaining a globally leading profitability level. The small and medium-size business has become the company's core growth engine, achieving systematic breakthroughs: in the IT field, monitor sales increased by 10% YoY, and laptop panel sales surged by 63%; in the mobile terminal field, LCD mobile phone panel shipments increased by 28% YoY, tablet panel market share rose to 13% (ranking second globally), automotive display shipment area increased by 47% YoY, and the professional display business maintained rapid growth, jointly driving high performance growth.

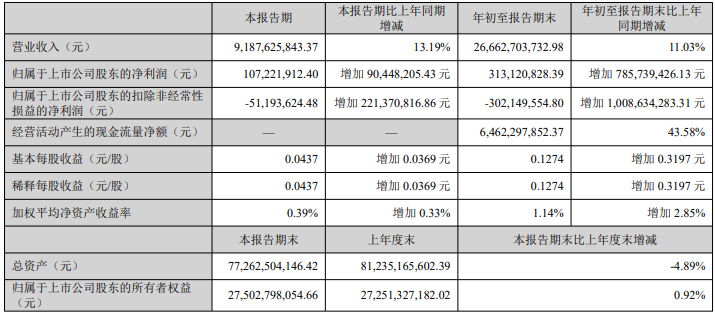

Tianma Microelectronics (Shenzhen Tianma A): Q3 Net Profit Attributable to Shareholders Surges 539.23% YoY

On the evening of October 30, Tianma Microelectronics Co., Ltd. released its Q3 2025 report. The company's overall operating situation was positive, with both operating revenue and net profit attributable to shareholders of listed companies achieving YoY growth, and performance steadily improving. The report shows that in Q3 2025, the company achieved operating revenue of 9.188 billion yuan, a YoY increase of 13.19%; net profit attributable to shareholders of listed companies was 107 million yuan, an increase of 90,448,205.43 yuan compared with the same period last year, with profit scale expanding significantly.

https://www.perfectdisplay.com/model-xm27rfa-240hz-product/

https://www.perfectdisplay.com/model-xm32dfa-180hz-product/

https://www.perfectdisplay.com/model-jm28dui-144hz-product/

In the first three quarters, the company's accumulated operating revenue reached 26.663 billion yuan, a YoY increase of 11.03%, with business scale expanding steadily; accumulated net profit attributable to shareholders of listed companies was 313 million yuan, an increase of 786 million yuan compared with the same period last year, achieving a significant transformation from loss to profit; accumulated net profit after deducting non-recurring gains and losses was -302 million yuan, also an increase of 1.009 billion yuan compared with the same period last year, with the main business loss further narrowing.

In terms of cash flow and asset status, the net cash flow from operating activities from the beginning of the year to the end of the period reached 6.462 billion yuan, a YoY increase of 43.58%, with cash flow adequacy improving significantly, mainly due to the YoY improvement in profits and the optimization of business collection.

Since the beginning of this year, the company's core business segments have shown a strong development trend, driving the steady growth of the company's revenue scale and significant improvement in profitability. Among them, non-consumer advantageous businesses such as automotive and professional displays have shown good development resilience, continuing to widen their leading edge; the operational efficiency of key businesses such as flexible OLED mobile phones has improved significantly; in addition, the profitability of businesses such as IT displays and sports health is also steadily enhancing.

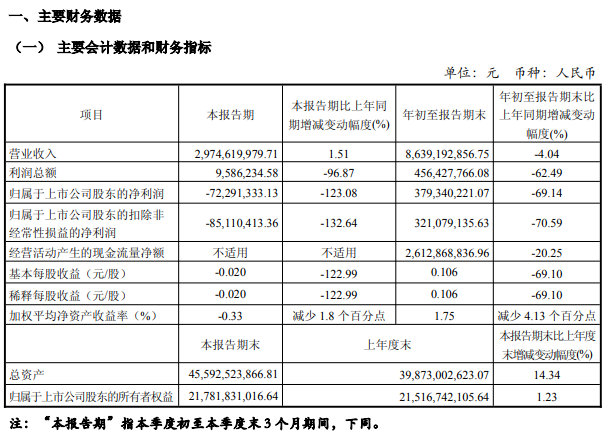

Rainbow Group: Net Loss of 72.2913 Million Yuan in Q3

On October 30, Rainbow Group released its Q3 report. In Q3, the company achieved operating revenue of 2.975 billion yuan, a YoY increase of 1.51%; net loss attributable to shareholders of listed companies was 72.2913 million yuan, a YoY decrease of 123.08%.

https://www.perfectdisplay.com/model-pm27dqe-165hz-product/

https://www.perfectdisplay.com/model-mm24dfi-120hz-product/

https://www.perfectdisplay.com/model-mm25dfa-240hz-product/

In the first three quarters, the company achieved operating revenue of 8.639 billion yuan, a YoY decrease of 4.04%; net profit attributable to shareholders of listed companies was 379 million yuan, a YoY decrease of 69.14%.

Huaxing Optoelectronics Technology: Q3 Net Loss Attributable to Shareholders of 245 Million Yuan

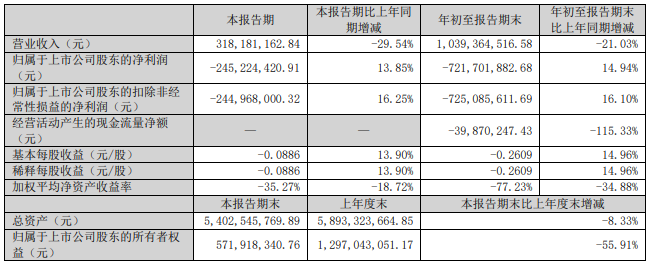

On the evening of October 20, Huaxing Optoelectronics Technology announced that in Q3 2025, it achieved operating revenue of 318 million yuan, a YoY decrease of 29.54%; net loss attributable to shareholders of listed companies was 245 million yuan; basic earnings per share (EPS) was -0.0886 yuan.

In the first three quarters, operating revenue was 1.039 billion yuan, a YoY decrease of 21.03%; net loss attributable to shareholders of listed companies was 722 million yuan; basic EPS was -0.2609 yuan.

https://www.perfectdisplay.com/model-mm24rfa-200hz-product/

https://www.perfectdisplay.com/model-cg34rwa-165hz-product/

https://www.perfectdisplay.com/model-qg25dqi-240hz-product/

Visionox: Revenue Growth in Jan-Sep

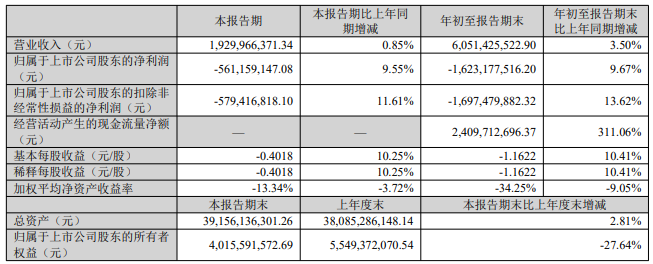

On October 30, Visionox (002387) announced its Q3 2025 report. The company's operating revenue was 6.05 billion yuan, a YoY increase of 3.5%; net profit attributable to shareholders turned from a loss of 1.8 billion yuan in the same period last year to a loss of 1.62 billion yuan, with the loss narrowing; net profit attributable to shareholders after deducting non-recurring gains and losses turned from a loss of 1.97 billion yuan in the same period last year to a loss of 1.7 billion yuan, with the loss narrowing; net cash flow from operating activities was 2.41 billion yuan, a YoY increase of 311.1%; fully diluted EPS was -1.1621 yuan.

Among them, in Q3, operating revenue was 1.93 billion yuan, a YoY increase of 0.8%; net profit attributable to shareholders turned from a loss of 620 million yuan in the same period last year to a loss of 561 million yuan, with the loss narrowing; net profit attributable to shareholders after deducting non-recurring gains and losses turned from a loss of 656 million yuan in the same period last year to a loss of 579 million yuan, with the loss narrowing; EPS was -0.4017 yuan.

https://www.perfectdisplay.com/model-qg32dui-144hz-product/

https://www.perfectdisplay.com/model-pg27rfa-300hz-product/

https://www.perfectdisplay.com/model-eg34cqa-165hz-product/

Longteng Optoelectronics: Net Loss of Approximately 180 Million Yuan in Jan-Sep

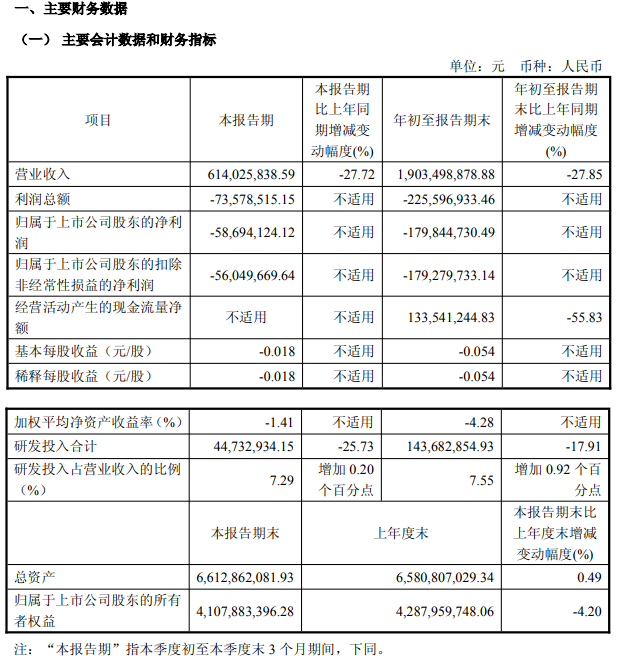

On the evening of October 29, Longteng Optoelectronics (SH 688055) released its Q3 performance announcement. In the first three quarters of 2025, revenue was approximately 1.903 billion yuan, a YoY decrease of 27.85%; net loss attributable to shareholders of listed companies was approximately 180 million yuan; basic EPS was -0.054 yuan.

Q3 revenue was 614 million yuan, a YoY decrease of 27.72%; net loss was 58.6941 million yuan.

https://www.perfectdisplay.com/model-em34dwi-165hz-product/

https://www.perfectdisplay.com/model-eb27dqa-165hz-product/

https://www.perfectdisplay.com/32-qhd-180hz-ips-gaming-monitor-2k-monitor-em32dqi-product/

Everdisplay Optronics: Q3 Net Loss of 530 Million Yuan

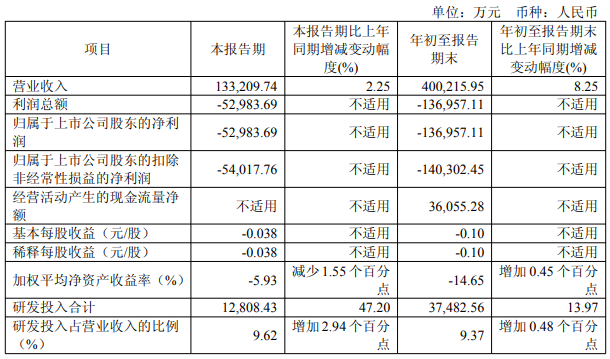

On the evening of October 30, Everdisplay Optronics (SH 688538) released its Q3 performance announcement. In the first three quarters of 2025, revenue was approximately 4.002 billion yuan, a YoY increase of 8.25%; net loss attributable to shareholders of listed companies was approximately 1.37 billion yuan; basic EPS was -0.1 yuan.

Among them, in Q3, operating revenue was 1.332 billion yuan, a YoY increase of 2.25%; net profit attributable to shareholders of listed companies was -530 million yuan; net profit attributable to shareholders of listed companies after deducting non-recurring gains and losses was -540 million yuan.

Truly International Holdings: Cumulative Consolidated Turnover Drops 5.2% in Jan-Sep

On October 10, Truly International Holdings (00732.HK) announced that the group's unaudited consolidated turnover in September 2025 was approximately HK$1.513 billion, a decrease of approximately 2.8% compared with the unaudited consolidated turnover of approximately HK$1.557 billion in September 2024.

The group's unaudited cumulative consolidated turnover for the nine months ended September 30, 2025, was approximately HK$12.524 billion, a decrease of approximately 5.2% compared with the cumulative consolidated turnover of approximately HK$13.205 billion for the nine months ended September 30, 2024.

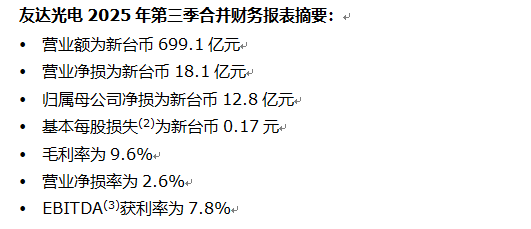

AU Optronics: Q3 Net Loss of NT$1.28 Billion

On October 30, AU Optronics held an investor conference to announce its consolidated financial statements for Q3 2025. The total consolidated turnover in Q3 2025 was NT$69.91 billion, an increase of 1.0% compared with Q2 2025 and a decrease of 10.1% compared with Q3 2024. The net loss attributable to owners of the parent company in Q3 2025 was NT$1.28 billion, with a basic loss per share of NT$0.17.

Looking back at Q3, the company's overall revenue increased by 1% QoQ. Among them, Display Technology's revenue was roughly flat compared with the previous quarter due to the appreciation of the New Taiwan Dollar (NTD) and the decline in panel prices, making the peak season effect this year less obvious than in previous years. Mobility Solutions' revenue decreased by approximately 3% mainly affected by the appreciation of the NTD. Vertical Solutions' revenue increased significantly by 20% QoQ this quarter due to the integration of Adlink Technology Inc. In terms of profitability, the quarter turned to loss due to adverse effects of exchange rates and panel prices, but the cumulative net profit attributable to the parent company in the first three quarters was NT$4 billion, with EPS of NT$0.52, a significant improvement compared with the loss in the first three quarters of 2024. Inventory days were 52 days, and the net debt ratio was 39.1%, with little change from the previous quarter, both maintaining at relatively healthy levels.

Looking forward to Q4, the display-related market enters the off-season, with material preparation demand slowing down and many variables in the overall economy. However, intelligent mobility and Green Solutions are steadily improving in line with customer demand. The company's team will continue to monitor market changes, optimize product mix, strictly control inventory, strengthen cost and expense management, and actively layout value-added products and solutions to enhance profitability and the ability to respond to market fluctuations.

Innolux: Q3 Consolidated Revenue Increases 4.2% YoY

On October 11, Innolux announced its financial report for September this year. The consolidated revenue in September was NT$19.861 billion, an increase of 6.3% month-on-month (MoM) and 2.7% YoY, reaching a new high in single-month revenue in the past 24 months.

The consolidated revenue in Q3 this year was NT$57.818 billion, an increase of 2.8% QoQ and 4.2% YoY. The cumulative consolidated revenue in the first three quarters of this year was NT$169.982 billion, a YoY increase of 4.4%. (Note: Innolux's investor conference will be held on November 7, when more specific revenue details will be announced.)

LGD: Q3 Operating Profit of 431 Billion Won, Turning from Loss to Profit

On October 30, LG Display (LGD) announced that on a consolidated basis, its revenue in Q3 2025 was 6.957 trillion won, with an operating profit of 431 billion won, a YoY increase of 2%, successfully turning from loss to profit.

As of Q3 this year, the cumulative operating profit was 348.5 billion won, and it is expected to achieve the first annual profit turnaround in four years. The cumulative revenue was 18.6092 trillion won, a decrease of 1% compared with the same period last year due to the termination of the LCD TV business. However, the cumulative operating performance improved by approximately 1 trillion won.

LGD stated that the revenue growth in Q3 was mainly driven by the expansion of OLED panel shipments, which increased by 25% compared with the previous quarter. The proportion of OLED products in the overall revenue reached a record high of 65%, driven by the launch of new small and medium-size OLED panels in addition to the seasonal peak.

In terms of sales proportion by product category (based on revenue), TV panels accounted for 16%, IT panels (including monitors, laptops, tablets, etc.) accounted for 37%, mobile panels and other products accounted for 39%, and automotive panels accounted for 8%.

Samsung Display: Q3 Operating Profit of 1.2 Trillion Won

On October 29, Samsung Electronics announced its Q3 financial results for the period ended September 30, 2025. The financial report shows that Samsung Electronics' Q3 revenue was 86 trillion won (approximately US$60.4 billion), an increase of 8.8% compared with 79 trillion won in the same period last year; net profit attributable to shareholders of Samsung's parent company was 12 trillion won (approximately US$8.4 billion), an increase of 22.75% compared with 9.78 trillion won in the same period last year.

Among them, Samsung Display (SDC) achieved consolidated revenue of 8.1 trillion won (approximately 40.4 billion yuan) and operating profit of 1.2 trillion won (approximately 6 billion yuan) in Q3.

SDC stated that in small and medium-size displays, performance improved due to strong demand for flagship smartphones and positive response to new product demand from major customers. In large-size displays, sales increased due to expanded demand for gaming monitors. It is expected that in Q4 2025, demand for new smartphones will continue, and sales of non-smartphone display products are also expected to increase.

Post time: Nov-04-2025