Computer Monitor Market Analysis by Mordor Intelligence

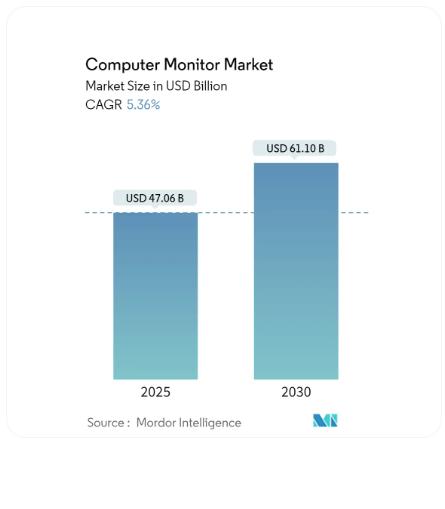

The computer monitor market size stands at USD 47.12 billion in 2025 and is forecast to reach USD 61.18 billion by 2030, advancing at a 5.36% CAGR. Resilient demand persists as hybrid work expands multi-monitor deployments, gaming ecosystems press for ultra-high refresh rates, and enterprises accelerate digital transformation. Manufacturers lift average selling prices by pairing 4K resolution with USB-C single-cable connectivity that streamlines desk setups. OLED and mini-LED technologies outpace LCD growth because corporate buyers value energy efficiency and color fidelity, while EU energy-efficiency rules compel continuous power-saving innovation. Intensifying competition encourages scale players such as Dell Technologies and HP Inc. to bundle services, leaving specialist brands to differentiate through panel breakthroughs and carbon-neutral designs.

Global Computer Monitor Market Trends and Insights

Gaming and e-sports proliferation

Global gaming-monitor shipments climbed sharply in 2024 as professional leagues standardized 240 Hz to 480 Hz refresh rates, prompting vendors to launch OLED panels with ultra-low latency[1]ASUS Republic of Gamers. "ASUS Republic of Gamers Unveils Three Premium 1440p Gaming Monitors during Gamescom 2024." August 21, 2024. . Hardware once confined to enthusiasts now permeates content-creator studios and financial-trading floors, widening the addressable base for premium displays. Tournament sponsors heighten visibility, encouraging mainstream consumers to view high-performance monitors as essential gear. Hardware companies also partner with e-sports organizations, converting brand affinity into steady volume contracts. Strong fan-driven demand underpins a double-digit growth runway even as broader PC sales level off.

Rapid adoption of 4K, HDR, OLED and mini-LED

OLED monitor volumes rose triple digits in 2024, supported by Samsung Display’s quantum-dot OLED capacity expansion that captured 34.7% of the premium segment. Mini-LED backlights bridge OLED-class contrast and LCD reliability, attracting medical-imaging and broadcast-editing buyers. HDR10 and Dolby Vision certifications transition from niche to baseline features, spurred by rising 4K video production. Suppliers leverage premium pricing to offset capital-intensive fabs while enterprises accept higher costs to secure energy savings and color precision. As factories reach scale, 4K panels displace 1440p in mainstream price tiers, reinforcing a virtuous upgrade cycle.

Hybrid/remote work multi-monitor demand

Portable and 27-inch monitors experienced triple-digit unit gains in 2024 as enterprises equipped distributed teams with standardized dual-screen kits[2]Owler. "ViewSonic's Competitors, Revenue, Number of Employees, Funding, Acquisitions & News - Owler Company Profile." April 24, 2025. . USB-C connectivity simplifies cabling, while embedded webcams and microphones support unified communications platforms. Employers justify higher budgets by correlating additional screen real estate with productivity upticks documented in internal time-and-motion studies. Vendors add ergonomic stands and blue-light filters to meet occupational-health mandates, further lifting bill-of-materials value. Momentum persists because hybrid work is now codified in corporate policy rather than treated as a stopgap.

Falling ASP of high-resolution panels

Panel oversupply in Asia Pacific pushed 4K LCD module prices below historic 1440p levels during 2024, enabling mass-market PCs to ship with UHD displays[3]TrendForce. "Global Monitor Market Set for Recovery in 2024, with Shipments Projected to Increase by 2%, Says TrendForce." February 5, 2024. . Manufacturers redeploy cost savings toward firmware that unlocks adaptive-sync and color-calibration features. Channel partners bundle monitors with mid-range GPUs, spurring whole-system upgrades and accelerating refresh cycles. Lower entry prices erode differentiation for basic 1080p models, pressuring suppliers to innovate beyond resolution. The pricing curve also compresses margins, prompting horizontal consolidation and OEM-ODM partnerships that share tooling expenses.

Competitive Landscape

The computer monitor market features moderate fragmentation; the top five vendors control an estimated 62% of global revenue, leaving room for niche entrants to address specialized use-cases. Dell Technologies leverages USD 95.6 billion in FY 2025 revenue to bundle monitors with endpoint-management software, reinforcing stickiness in Fortune 500 accounts. HP Inc., with a USD 53.6 billion FY 2024 turnover, adds device-as-a-service plans that rotate displays every 36 months, smoothing enterprise cash flow. Samsung Display and LG Display dominate OLED and mini-LED panel supply; their downstream brands capture premium-segment margins by touting proprietary pixel-shift algorithms that mitigate burn-in risks.

Gaming-centric firms like ASUS Republic of Gamers and MSI differentiate through 480 Hz refresh-rate leadership and community engagement programs that cultivate brand evangelists. ViewSonic secures a 26.4% share in portable monitors by emphasizing macOS compatibility and factory color calibration. Component innovations such as DisplayPort 2.1 retimers and micro-LED backplanes drive patent races; firms lacking research and development heft enter licensing deals or risk obsolescence. M&A activity centers on software assets that add calibration, remote-management, or collaboration value, echoing a broader hardware-plus-services convergence.

Cost competition persists at lower tiers, where Chinese ODMs flood the channel with aggressively priced IPS models. Brand owners protect margin by stressing extended warranties and responsive after-sales support. Supply-chain resilience becomes a differentiator; multinationals dual-source panels from Korea and China to hedge geopolitical shocks. Sustainability credentials gain importance as ESG disclosure rules tighten; manufacturers publish lifecycle-carbon data and adopt recyclable packaging to win institutional buyers, reinforcing a non-price competitive dimension.

Post time: Aug-28-2025